Jan 6, 2026

For most of the last crypto cycle, token launches and TGEs (Token Generation Events) followed a predictable formula.

Low float. High FDV (Fully Diluted Valuation). Heavy reliance on airdrops to drive distribution and attention.

That formula is losing credibility.

As we move into 2026, teams are rethinking how tokens enter the market, who receives them, and how to prevent value from leaking to Sybil farms and short-term extractors. The result is a new format of TGEs and token sales where airdrops are optional, filtered, or replaced entirely.

This shift matters for any team planning a launch. It also reshapes the role of identity and Sybil resistance infrastructure in web3 – the focal point for Passport and the human.tech ecosystem.

The Backlash Against Low Float, High FDV Launches

Launching with a minimal circulating supply and aggressive valuations became common in 2023 and 2024. Many projects entered the market with under 10 percent of supply unlocked, followed by steep vesting schedules. The outcome has been widely discussed around crypto twitter and beyond.

Starknet’s token declined by more than 60 percent from launch levels despite an increase in market capitalization, highlighting the impact of dilution and sell pressure over time. AltLayer followed a similar trajectory, with token price performance diverging sharply from headline valuation metrics.

These cases are now frequently cited in founder and investor conversations around launch design. In response, newer projects are adjusting their approach:

Higher day-one float, commonly in the 15 to 25 percent range

Fully diluted valuations aligned with final private round pricing

Price-based or milestone-based unlocks instead of fixed timelines

The underlying goal is to reduce structural sell pressure and rebuild trust in token launches.

Token Launch Models Are Diversifying

Sales should be onchain, with transparent, dynamic price discovery. Rather than relying on a single mechanism, many projects now combine several launch models. Recent launches illustrate this shift:

Liquidity Bootstrapping Pools and auction-based mechanisms like Continuous Clearing Auctions, used for market-driven price discovery

Fair launches with limited or no private allocations

Tiered Initial DEX Offering (IDO) and Initial Exchange Offering (IEO) structures that balance accessibility and reach

Loyalty-based seeding followed by liquidity incentives

Jupiter’s rollout is a clear example. Early distribution rewarded engaged users, while later liquidity mechanisms allowed the market to establish the price without overwhelming sell pressure.

Overall, the pattern is consistent: token launches are becoming modular rather than monolithic, with novel sale mechanisms playing an important part.

Airdrops Are Evolving

Airdrops are not disappearing, but their role is changing.

The points-farming era rewarded volume over contribution, driven by automated wallets optimized for extraction rather than providing value. In response, over the last year, teams have been shifting toward mechanisms that favor persistence, context, and real engagement.

Common changes include:

Activity-based signals rather than raw transaction counts

Vesting applied to airdrop claims, not only team or investor allocations

Multi-phase distributions spread across time instead of a single release

Optimism’s phased distribution model has shown measurable improvements in short-term retention compared to one-off airdrops, reinforcing the idea that distribution design shapes community behavior.

The Return of Token Sales and ICO 2.0

Alongside changes in TGE design, token sales are returning in an upgraded form. Multiple reports in 2025 point to a resurgence of ICO-style fundraising. ICO, or Initial Coin Offering, is a fundraising model first popularised in crypto back in 2017, allowing projects to sell pre-minted tokens directly to the public. It’s a way for startups to bypass traditional funding routes and engage directly with the crypto community.

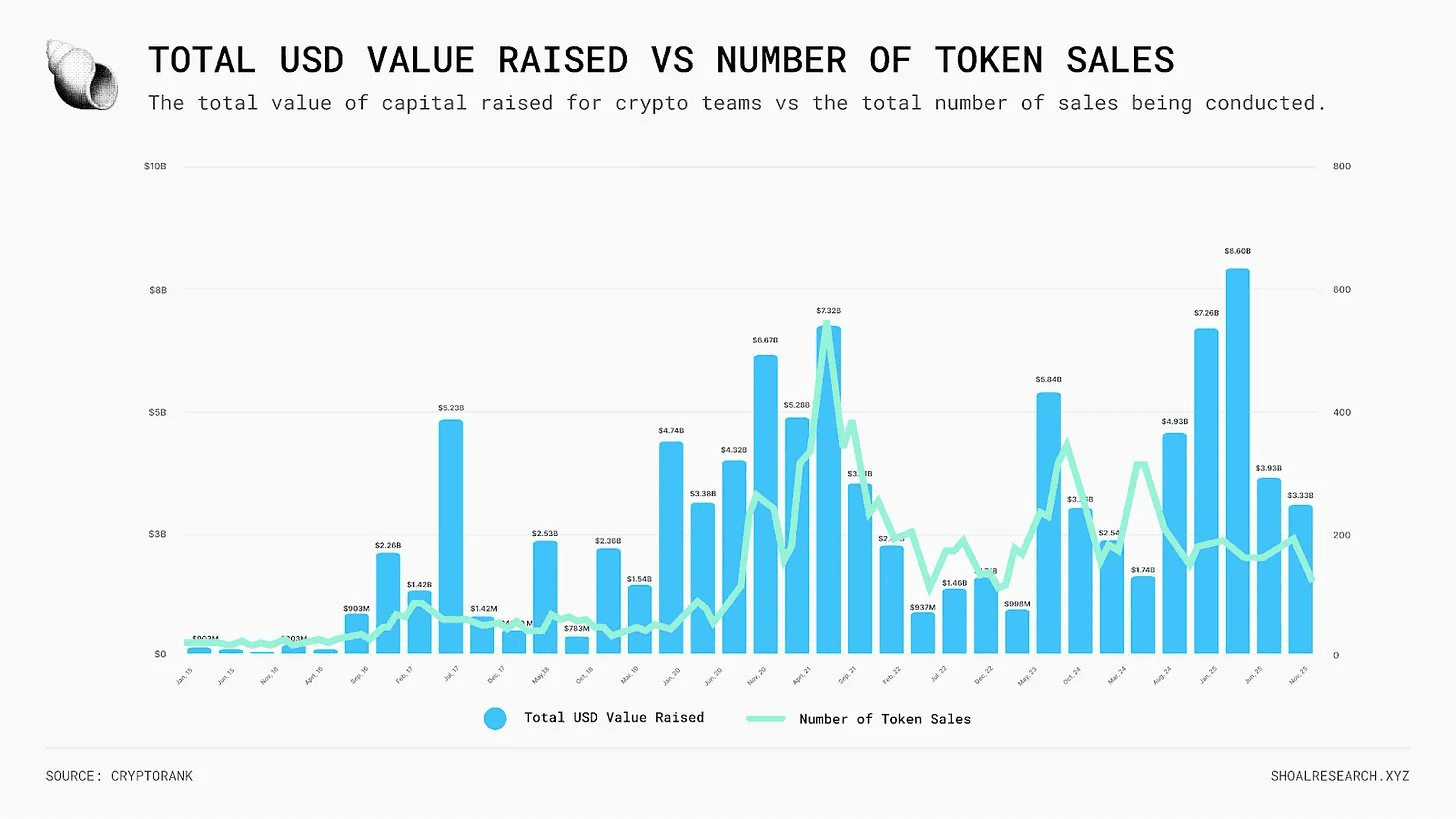

In 2025, high-profile raises have again closed fast, with funding volumes comparable to previous bull market cycles (althogh concentrated around fewer projects). In March 2025, the broader web3 and blockchain ecosystem saw billions of dollars in funding activity, with reports indicating more than $3.3 billion raised across 96 projects in that month alone. In July 2025, Pump Fun raised $600M for PUMP in the third-largest ICO ever. Just recently, in December 2025, Aztec Network has conducted its ICO, raising 19,388.46 ETH. Teams like OneFootball ($3M), Reya ($3M), and Rainbow ($3M) all completed ICOs, with more sales expected in the coming months.

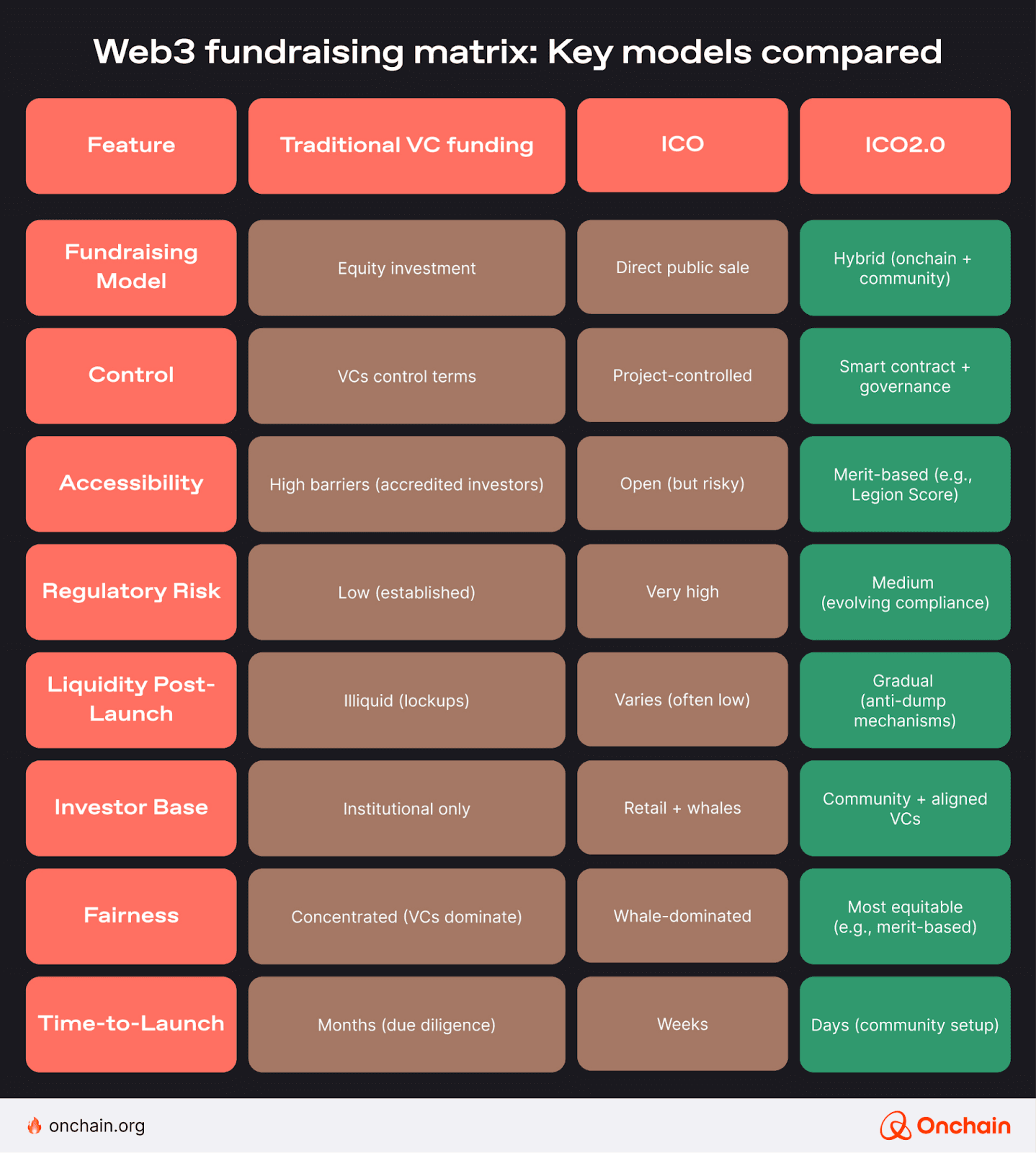

The current renaissance of ICO fundraising does not represent a return to 2017-era mechanics, but an upgrade enabled by onchain programmability and improved compliance tooling.

Source: onchain.org

Why Token Sales Are Returning

Three forces are converging:

Regulatory recalibration, including signals of softer enforcement in specific cases

Community pushback against heavily VC-weighted allocations

Less private funding compared to 2021/2022, teams lean towards public sales

New launch platforms focused on transparency and allocation logic

Example ICO Platforms

Platforms such as Echo and Legion are experimenting with onchain selection rules, reputation signals, and structured participation.

Tally provides governance-native primitives for proposals, voting, delegation, and permissioned participation, and is increasingly used to coordinate token sales and onchain distributions through DAO-controlled flows.

Token Ops focuses on execution-layer token operations, including vesting, allocations, distributions, and compliance-aware workflows.

Incumbents like CoinList have tested gated access, eligibility criteria, and compliance-aware participation models.

Token Launches x Identity: From ICOs to Identity-Gated Launches

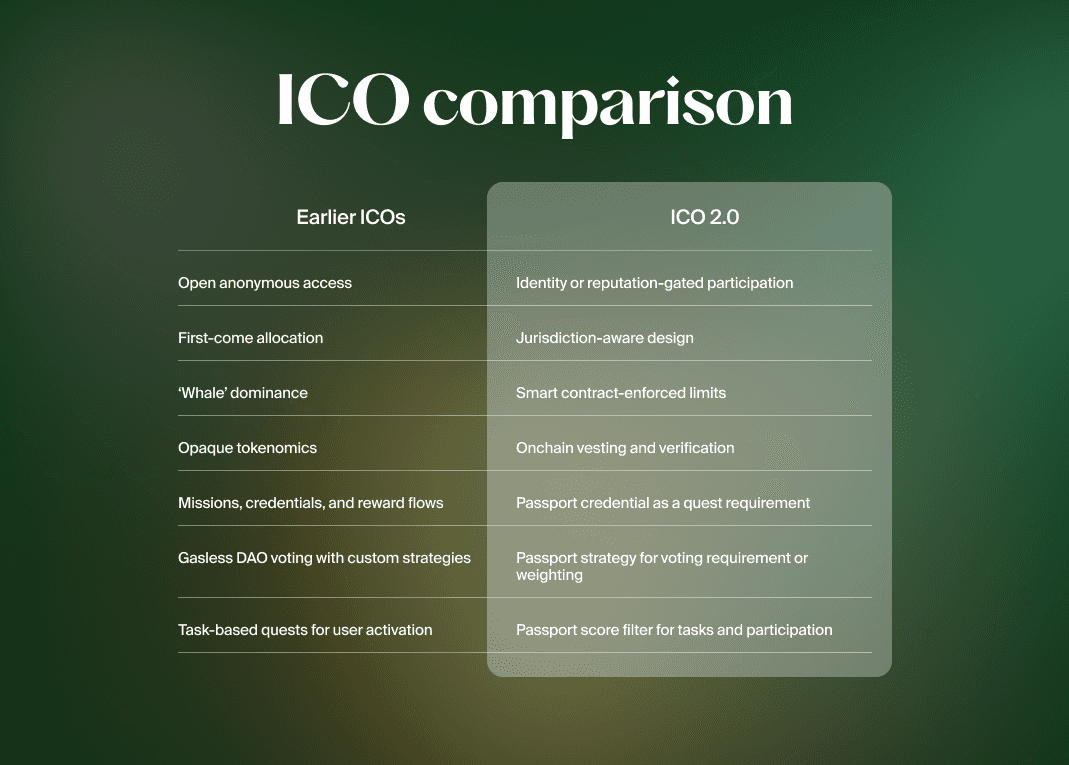

The defining change for 2026 ICOs is the selection of participants - from open, first-come-first-served unregulated access to gated jurisdiction-aware participation, with access limits enforced through smart contracts. Below is the table explaining the shift.

Who gets access now matters as much as how much capital is raised.

Sybil Resistance Is Now Expected

In the last few years, several high-profile launches exposed the cost of weak Sybil defense.

Post-launch analyses of Arbitrum and zkSync highlighted large clusters of wallets capturing disproportionate shares of airdrop allocations. LayerZero exposed 800,000 Sybil wallet addresses. In some cases, millions of tokens were flagged as potentially farmed through coordinated activity.

As a result, teams are now combining multiple filtering layers before distribution:

Behavioral and clustering analysis using onchain data

Proof-of-personhood systems with varying privacy guarantees

Token or history-gated eligibility requirements

Reputation-based filters that exclude inactive or suspicious wallets

Sybil defense is no longer an experimental add-on. It is becoming the baseline expectation. In modern token launches, Sybil resistance filters participation, while compliance mechanisms handle jurisdictional and regulatory constraints. The layers increasingly operate together, but solve distinct problems.

Compliance Is Becoming a Strategic Signal

While regulatory pressure remains, how teams handle it is changing.

Between 2021 and 2023, compliance was often addressed through blunt exclusions. Entire jurisdictions were blocked, and rules were enforced at the frontend (if at all). This approach proved fragile as token launches became more visible, global, and scrutinized.

In 2024-2025, more teams designed launches that can support jurisdiction-aware participation, exchange requirements, and institutional access from the start. KYC and AML readiness increasingly correlate with faster listings and broader distribution, even when full identity checks are not required for every participant.

At the same time, teams grew cautious about over-collecting user data. This has driven interest in privacy-preserving verification methods that allow projects to demonstrate compliance-relevant properties without full doxxing and storing unnecessary user data. Zero-knowledge techniques and modular identity layers are increasingly used to balance due diligence with user privacy.

Compliance is no longer a binary choice between open access and full KYC. It is becoming a configurable layer that teams adjust based on risk, jurisdiction, and launch phase.

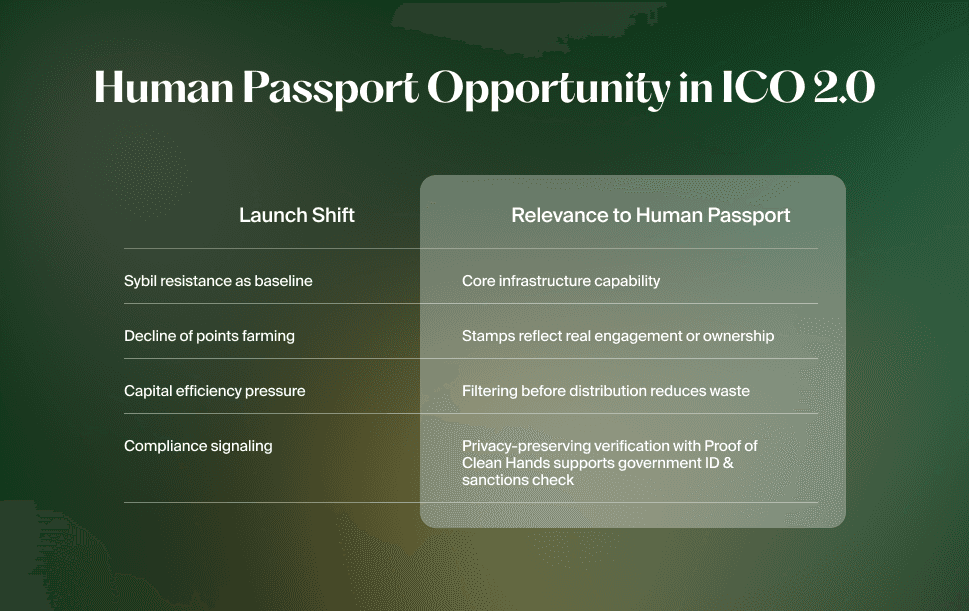

The Human Passport Opportunity in ICO 2.0

As more teams move beyond airdrops and toward selective distribution, identity becomes part of the primary infrastructure, not an afterthought. Several extensions follow naturally from the formulating trends that Human Passport already supports:

Pre-TGE Sybil audits using one-time scoring of eligible wallets through Passport Data Services.

Dynamic eligibility thresholds that adapt to attack pressure through Passport Stamps & Models.

Privacy-preserving compliance flow with Proof of Clean Hands.

Post-distribution analytics linking wallet and holder behavior through Passport Diamond Hands.

Direct in-flow verification without redirects with Passport Embed.

These tools help move identity from simple community gating toward a full lifecycle effort with clear insights. ICO 2.0 requires identity without surveillance. Initially launched to protect Gitcoin Grants, Human Passport is a long-time industry leader in providing privacy-preserving proof of personhood, proof of humanity, and Sybil defense.

This positions Human Passport as a neutral privacy-first verification layer that token launch platforms can integrate rather than rebuild their defense from scratch.

In previous years, Sybil wallets captured a significant share of major airdrop distributions.

In 2026, projects using PoH tools like Human Passport significantly reduce capital leakage to Sybil farms and route tokens to real community members who participate long-term.

Token launches should optimize for humans, not for wallets. Hopefully, ICOs 2.0 help maintain a healthier user-to-Sybil balance for web3.

FAQ

Why are teams moving away from points-based airdrops?

Points systems reward volume and automation more than contribution. As Sybil activity increased, many projects saw large portions of airdrops captured by farms rather than real users. New models prioritize engagement quality, persistence, and verifiable history.

What role does Sybil resistance play in modern TGEs?

Sybil resistance is becoming a baseline requirement. Teams use it to protect token distribution, improve community quality, and reduce wasted incentives. It is increasingly applied before claims open, not after issues surface.

How does Human Passport differ from KYC?

Human Passport enables projects to prove that participants are real humans while preserving user privacy and minimizing data collection. The formal identity verification with government ID is optional and fully privacy preserving.

Can Human Passport be integrated into launch platforms?

Yes. Human Passport is designed as an infrastructure. Launch platforms and token issuers can integrate Passport as a verification layer rather than building custom identity or reputation systems themselves.

Is Human Passport only useful for airdrops?

No. Human Passport is relevant across the full token launch lifecycle, including pre-TGE eligibility checks, fair launch participation, ICO 2.0 access gating, and post-distribution analytics.

Does proving humanity reduce participation?

In practice, identity improves participation quality. Projects that filter for real humans often see fewer claims but stronger retention, healthier governance participation, and more aligned communities.